All Categories

Featured

[/image][=video]

[/video]

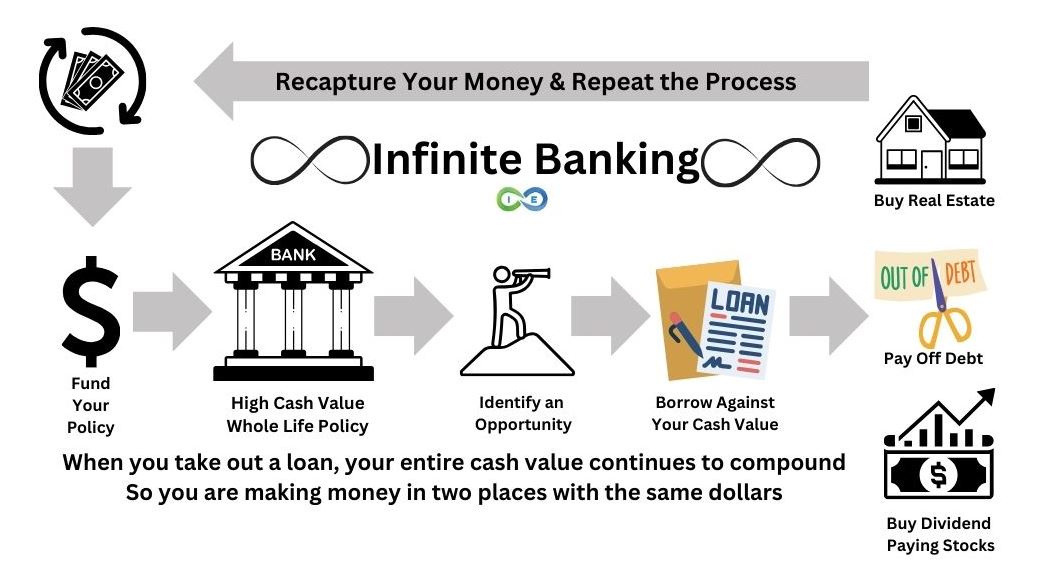

Let's state you have a hundred thousand dollars in a bank, and afterwards you discover it a financial investment, a submission or something that you're desiring to place a hundred thousand right into. Now it's gone from the bank and it remains in the syndication. It's either in the bank or the submission, one of the two, but it's not in both.

It really is. And I try to assist individuals recognize, you recognize, just how to enhance that performance of their, their cash to ensure that they can do even more with it. There's this idea. And I'm really mosting likely to attempt to make this simple of using an asset to acquire an additional property.

Genuine estate capitalists do this all the time, where you would certainly accumulate equity in a realty or a home that you own, any, any actual estate. And after that you would certainly take an equity setting versus that and utilize it to acquire another property. You recognize, that that's not an an international idea in all, remedy? Completely.

And after that using that property to buy even more real estate is that after that you become very subjected to genuine estate, suggesting that it's all associated. All of those properties end up being associated. In a downturn, in the entirety of the real estate market, then when those, you recognize, things begin to lose value, which does take place.

It hasn't taken place in a while, however I don't understand. I bear in mind 2008 and 9 pretty well. Uh, you understand, and so you do not desire to have every one of your assets associated. So what this does is it gives you an area to place cash originally that is entirely uncorrelated to the realty market that is mosting likely to exist assured and be assured to enhance in worth with time that you can still have an extremely high collateralization element or like a hundred percent collateralization of the cash value within these policies.

Becoming Your Own Banker Nelson Nash Pdf

I'm attempting to make that as basic as feasible. Does that make sense to you Marco?

If they had a house worth a million bucks, that they had $500,000 paid off on, they could possibly obtain a $300,000 home equity line of credit history because they commonly would obtain an 80 20 lending to value on that. And they might get a $300,000 home equity credit line.

Nelson Nash Life Insurance

For one thing, that credit history line is taken care of. In other words, it's going to remain at $300,000, no issue how long it goes, it's going to stay at 300,000, unless you go obtain a brand-new appraisal and you obtain requalified financially, and you boost your debt line, which is a big discomfort to do every time you put in money, which is generally as soon as a year, you contribute brand-new resources to one of these specially developed bulletproof wealth plans that I create for people, your inner line of credit history or your access to funding goes up every year.

Latest Posts

Infinite Banking Think Tank

Become Your Own Bank - Financial Security Seminar

Ibc Be Your Own Bank